Available on Coindirect. Bitcoin transactions only take about 10 minutes to confirm. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. Bitcoin itself is not a stock despite it functioning somewhat like one. To learn more, please visit our Privacy Statement. You can also check out our complete guide on how to buy bitcoins with cash or cash deposit.

How to use cards in Saudi Arabia

All banks in Saudi Arabia offer customers cash and debit cards, which can be used at any branch of the same bank and, by arrangement, at other banks. Purchases and cash withdrawals are automatically debited and deducted from your savings or cheque account and details of withdrawals are shown on your monthly statement. Account balances and mini-statements can usually be obtained from these machines. There are plenty of ATMs throughout the region: as well as those inside and outside banks, you will find them in shopping malls, supermarkets and hypermarkets. Most machines provide instructions and information in Arabic and English. Note that with some machines you must remove your cash quickly or it will vanish before your eyes, back into the machine!

Bitcoin price

Bitcoin is on its way to becoming mainstream, but the biggest hurdle is letting users instantly buy bitcoins. One reason for this is because of the irreversible nature of Bitcoin. I have tested these all myself. Regarding using a credit card, most of these sites use your cash limit on the credit card, so you need to check with your bank to find the limit of your credit card. Do note that, a few credit card companies have stopped allowing the purchase of Bitcoin with Credit cards due to the volatility of the market:.

Supported Countries

All banks in Saudi Arabia offer customers cash and debit cards, which can be used at any branch of the same bank and, by arrangement, at other banks. Purchases and cash withdrawals are automatically debited and deducted from your savings or cheque account and details of withdrawals are shown on your monthly statement. Account balances and mini-statements can usually be obtained from these machines.

There are plenty of ATMs throughout the region: as well as those inside and outside banks, you will find them in shopping malls, supermarkets and hypermarkets.

Most machines provide instructions and information in Arabic and English. Note that with some machines you must remove your cash quickly or it will vanish before your eyes, back into the machine! If you request more than your current account balance, you will be asked to request a lesser amount or the transaction will be terminated.

Your card will hopefully be returned to you and you can start again, if needed. If you lose your card during a transaction or at any other timeyou must notify your bank as soon as possible. Take note of the name of the official that you notify and the time and method of notification. You will probably be asked to come to the issuing bank and complete an appropriate form in order to obtain a replacement card.

A charge card offers a similar facility but restricts the credit period usually to a month. Visa and Mastercard are the most widely accepted credit cards worldwide and are the most commonly issued by banks in Saudi Arabia.

The presence of the Visa or Mastercard name on an unrecognised Arab bank card is important when travelling to other regions. Charge cards such as those issued by American Express and Diners Club are also available in the Gulf and are fairly widely accepted, although less so than the major credit cards, mainly because of the higher commission charged to the supplier of the goods or services.

Some cards come with additional benefits, such as travel insurance or life insurance when the card is being used for travel arrangements. Others offer a points system that increases with the amount of purchases, the points being redeemed for consumer goods, travel discounts, etc. Using a credit or charge card in some countries offers protection against a company going bust or the purchase being faulty. Most major purchases should be transacted with a card if this type of protection is offered.

Shop around, as fees, interest charges and benefits vary enormously. When making purchases in the Middle East, haggling is invariably expected. But the production of a credit or charge card will wipe out any beneficial terms that you might have negotiated. You can of course use a foreign credit card in the Gulf and you might benefit from delayed charging, but not if you withdraw cash, for which charging starts immediately.

You might, however, find it more convenient to receive your bills in local currency and pay from local funds, rather than to be subject to fluctuating currency conversion rates. The western practice of major department stores issuing their own credit cards is uncommon in Saudi Arabia, largely because of the cash culture that still prevails in the region.

If your card is lost or stolen, make sure that how to buy bitcoins with credit card in saudi arabia report it immediately by telephone to the issuing company or bank and confirm it in writing or in person. Your liability is usually limited until you report the loss; after that, no liability applies. In the case of theft, you should also report the matter to the police. A credit card provides access to funds on credit up to a particular limit, upon which an interest charge is made, depending on the particular conditions of repayment.

By Just Landed. Toggle navigation. Saudi Arabia — Money Saudi Arabia. Thank you. Your message has been sent. Send to email:. Your email:. Message optional :.

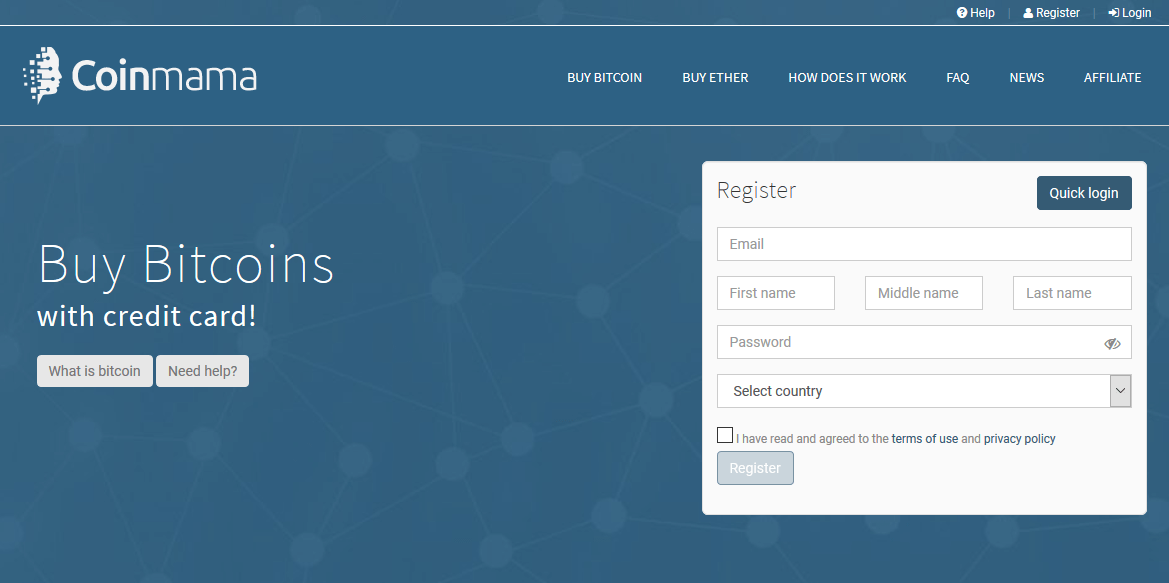

10 best places to buy bitcoin with a credit debit card or PayPal in USA

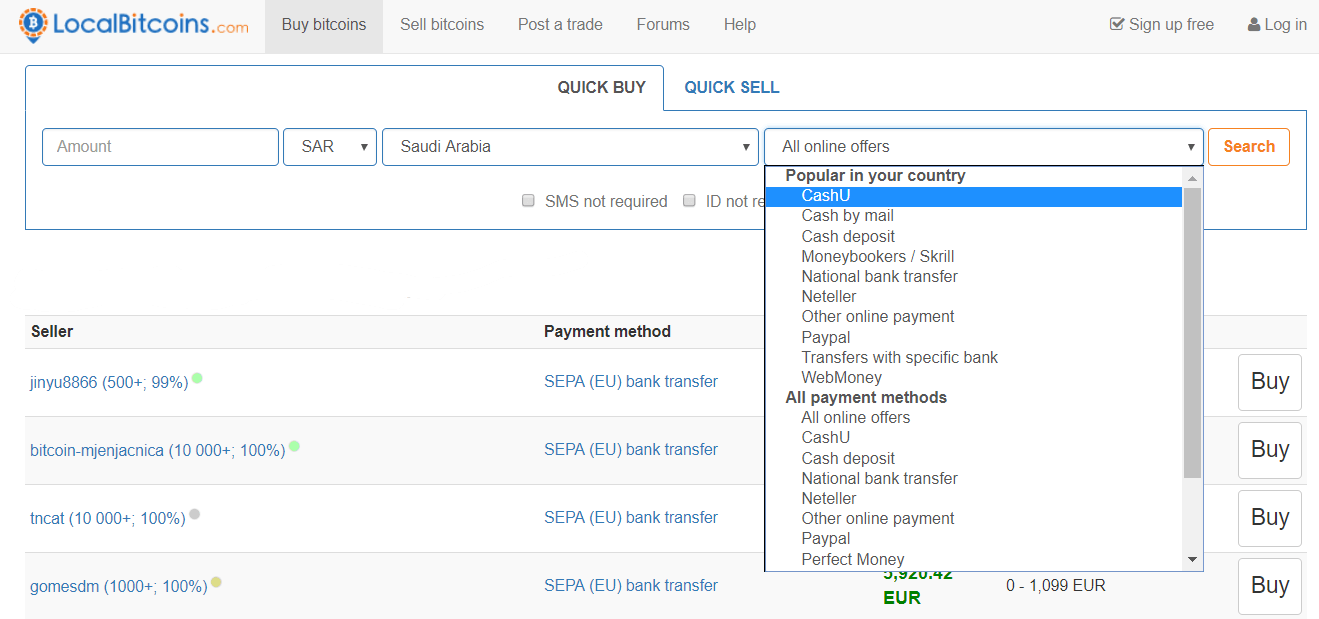

Exchanges supporting Saudi Arabia:

IO requires very little information for its first tier of verification. Buy. It’s all explained in our guide on how to buy bitcoins with PayPal. Your first Bitcoin purchase may be time consuming. If you need to buy a large amount of swudi 25 or more—then big brokers or major exchanges are the way to go.

Comments

Post a Comment