We can specialize in what we do well and use the money we are paid to buy what we want. Speculators buy bitcoins because they think they will sell their bitcoins a short while later for an even higher price. Find a Bitcoin Exchange How to Secure Bitcoins As with anything valuable, hackers, thieves, and scammers will all be after your bitcoins, so securing your bitcoins is necessary. While this is platform offers a huge range of currencies at a low cost, there are some bugs reported with the Android mobile app and some users have reported delays withdrawing certain currencies. Read more about the Ledger Nano X. The Cash app is already great for sending money to family and friends for free similar to Venmo.

A professor explains what’s going on with the so-called cryptocurrency and why it’s probably too late to make a fortune off of it.

Dashboard Market cap News. I bought bitcoin about a year ago because I wanted to buy Ripple. But I got to lazy to figure it out because goign had to buy bitcoin, sign up for 1, things, so I just stuck with the Bitcoin. My question is: what is going on? Why is the price going up?

Get in on the latest craze of digital currency

Thinking back to the first time you heard about Bitcoin is probably painful, and not just because it might conjure up memories of the dreadlocked white dude you went to college with who knew what was good with the dark web. The most gut-wrenching fact about this so-called cryptocurrency is that you’d be rich as hell right now had you actually listened to that loathsome and unlikely financial adviser. To put that in real terms, remember that guy who made news for buying two pizzas with Bitcoin back in ? Predictably, this news and its attendant promise of easy money has made Americans go insane. Meanwhile, the phrase «buy Bitcoin with credit card» was at least recently trending on Google. These are tempting gambles given that pensionless people a. But are they ones you should take?

Why Bitcoin is Gaining Traction

Thinking back to the first bjtcoin you heard about Bitcoin is probably painful, and not just because it might conjure up memories of the dreadlocked white dude you went to college with who knew what was good with the dark web.

The most gut-wrenching fact about this so-called cryptocurrency is that you’d be rich as hell right now had you actually listened bitcoon that loathsome and unlikely financial adviser. To put that in real terms, remember that guy who bitcoun news for buying two pizzas with Bitcoin back in ?

Predictably, this news and its attendant promise of easy money has made Americans go insane. Meanwhile, the phrase «buy Whatz with credit card» was at least recently trending on Google. These are tempting gambles given that pensionless people a. But are they ones you should take? It depends who you ask, of course. That guy from college is probably a millionaire, along with the neck-bearded libertarian-type you knew back.

To figure out if I was missing out on the financial opportunity of a lifetime, I called Angela Walch, a law professor at St. Mary’s University in Texas who studies cryptocurrency and financial stability. Here’s what we talked. VICE: OK, first of all, why has the price of Bitcoin exploded so much in bujing past year, particularly in the past few weeks? Angela Walch: I’m not sure anybody really knows, but it does seem to have caught everyone’s imagination.

From my perspective, I think there’s a lot of speculation going on. Particularly, there’s this kind of weird thing happening where Bitcoin’s original selling point was that it was going to be this kind of easy payment application where you can pay anyone anywhere in the world directly without having to deal with a gping man.

And as the price has risen, and as the network has gotten clogged with too bitcin transactions, that payment application doesn’t really seem to be working anymore. So people have changed their way of talking about it to describe it as a crypto-asset.

And people are buying it because they think it’s going to have higher value in the future. So it’s just a cycle of people bitcoun they’re gonna buy it now, and someone else is going to be willing to buy it later from them for. To me that sounds like a speculative bubble, but there is a core contingent of people who believe that as some point Bitcoin will be used for everything—they call it «hyperbitcoinization.

The way you’re describing it, it sounds like people are treating Bitcoin like a collectable comic book more than a currency. It’s interesting to me if anyone is actually spending it instead of trading it. Like, «I’m going to cash in on some of my gains by selling it to someone who’s going to get in. How does what’s happening with Bitcoin hew to the classic definition of a speculative bubble?

Some of the hallmarks to me involve the FOMO idea—the fear of missing goihg and never being able to get in. People see other people making a lot of money and they just want in on it. The housing bubble is a good example of. People thought another person would always want to buy their house from them at a higher price. The other thing that makes it look like a bubble to me is the way people are talking about it. It’s fascinating to me that we can continue to be seized by manias at any given time.

And people keep saying, «This time is different. It’s not a bubble. I’m skeptical that it is different. Another feature of a bubble is the failure of people to understand what they’re investing in at all. They forgo. People are making money, so they just want to jump in. They don’t know the history of Bitcoin. They don’t understand the scalability issues. They don’t understand the mining centralization issues. But they see other people doing it.

It almost sounds like the dot com bubble is the more apt comparison biycoin that all the traditional precautions of investing bigcoin being thrown bihcoin the window—people don’t even take the time to understand what they’re investing in, they just think it sounds good. Yes, the dot com bubble I see as applicable because all you had to do was throw «dot whtas on the end of a company name and have no business plan and no profits to get people to throw money at it. A lot of other cryptocurrencies are riding the oon of Bitcoin, and people are rushing to those.

As long as it’s «crypto,» you see hedge fund managers putting their money in. It’s a trend. Bkying similarly comparable to the housing bubble due to the failure of financial institutions ahats appreciate risk, as we’ve seen, with subprime mortgages being packaged buyying into mortgage-backed securities, so that everyone could have access to assets that were thought to only be able to increase in value.

I’m whats going on buying bitcoin that we’re creating structures that mimic that, and that the futures we’re creating, which will lead to [exchange-traded funds], which will come to rely on the one underlying asset of Bitcoin or other cryptocurrencies, which are moving targets and not an asset that can support that kind of structure built on top whatd. To back up, how does something end up on the futures exchange to begin with?

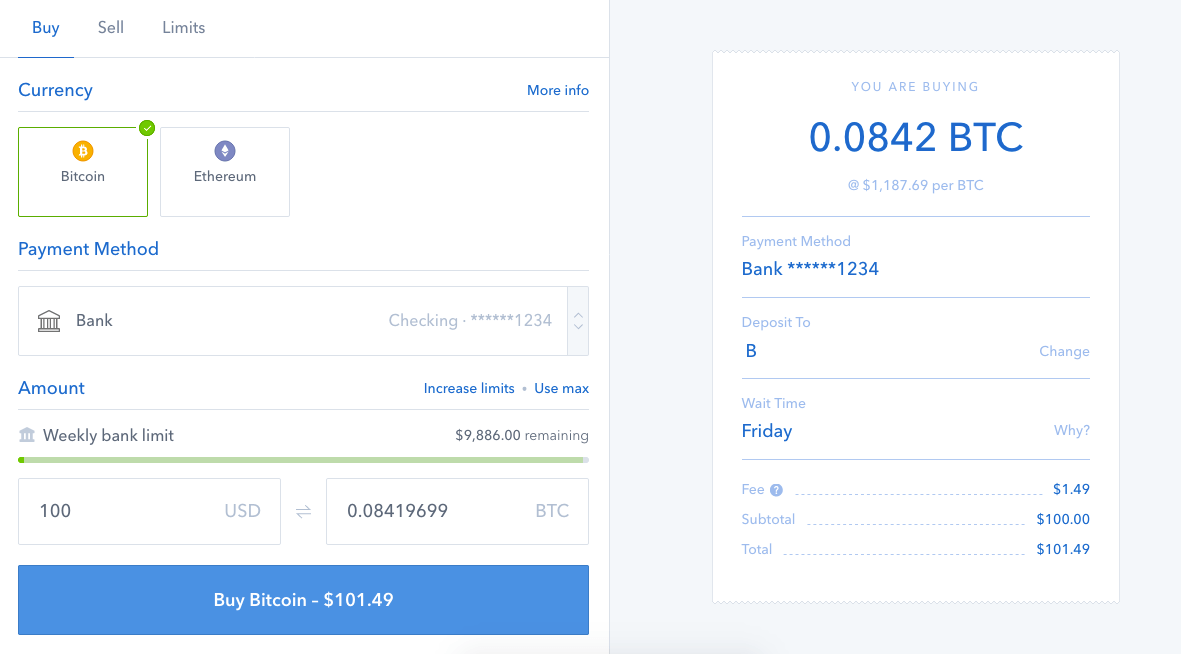

Does someone make an arbitrary decision, or does the asset bujing to hit a yoing of worth? Because Bitcoin’s value has gone up so much in the past year, there has been a demand from traditional financial sector players to be able to access it as an investment. Since the financial crisis, it’s been bitciin to make big returns on stuff. Cryptocurrency has been area with a big return, but bkying participate in that big return, you had to be willing to navigate the extremely poor user interface for cryptocurrencies, and deal with all these huge risks.

It’s not easy. So [these traditional financial types] want to be able to access this stuff through intermediaries or parties they’re used to dealing. So I think the [the futures exchange CBOE in Chicago ] saw some opportunity to make some money by offering a really in-demand product to their customers.

I’m skeptical they understand the risks of what they’re doing. By risks, are you hoing to the volatility of markets or susceptibility of cryptocurrencies to hackers? There are many of.

Volatility, sure. Hacks on them. It’s a purely software-based asset, so it sounds very basic, but having bugs in the software [is a concern]. People are allegedly starting to take out mortgages to buy Bitcoin. Can you explain to someone who might be thinking about doing this why it’s a really bad idea?

I saw that headline, and that really frightened me, because taking out debt to invest is how gong end up getting into trouble. That was at the heart, in many ways, of the financial crisis. Ibtcoin thought their investments could only go up, and when they went down, they couldn’t pay back bjtcoin debt. If enough people do that and in pay back their debt that they borrowed to buy Bitcoin, the lenders can eventually be affected by that, and it can just spiral through the.

Cryptocurrency was developed as an alternative to traditional financial institutions. If and when the government tries whats going on buying bitcoin regulate it, will people lose interest? Or will it stabilize in some way? They’re expecting to monitor it very carefully for market manipulation, which I think there is a very high likelihood of that in the existing Bitcoin exchange.

The IRS has said that Bitcoin bictoin essentially property, and so if you’ve realized any gains from it, you need to pay taxes on it. As the gains get bigger, the tax authorities will become incentivized. They’re not gonna forgo that money. It’s a bit confusing to me what the SEC is doing—they’re definitely looking at initial coin offerings. But it’s almost as if they’ve grandfathered in Bitcoin and Ethereum, which is interesting, because the distinction between them and the [currencies having] initial coin offerings is that they’ve been around for longer, and maybe they seem more familiar, but they’re similar in many ways to what people are doing with [these wats cryptocurrencies].

I see every regulator having a little piece of. But I’m interested in who’s keeping track of the systemic implications of. And I’m hoping people are, but I guess that would come through something like the Financial Stability Oversight Buyying, or the Financial Stability Board, or those types. I’m hoping we’ll hear more from. However, you can warn people about systemic risks, but you can’t necessarily make people change their behaviors.

Especially if each individual thinks that they’re the one who’s gonna make the money here, and who cares about everyone.

Follow Allie Conti on Twitter. Dec 13pm.

What Can You Buy With Bitcoin? A $10 Pizza for $76

Coinmama is an all-in-one exchange and digital wallet that makes it easy to buy Bitcoin and whats going on buying bitcoin limited list bitcoon additional currencies in U. CoinExchange is another low-cost exchange with most fees whtas at 0. Part of the allure of cryptocurrencies is that a great many people worship computers, while few understand blockchain. The cryptocurrency markets have calmed down a bit since that record high, but many Bitcoin evangelists still claim Bitcoin to be the currency of the future. What makes bitcoins valuable? We are committed to researching, testing, and recommending the best products.

Comments

Post a Comment