The fact that Bitcoin is not controlled or administered by a large bank or government entity is part of its appeal for many—but that also makes it harder to understand. Your E-Mail Address. There are many more potential applications of blockchain technology. Print Email Email. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. For more on blockchain, see below.

Key takeaways

Fidelity Investments is spinning off a stand-alone company dedicated to bringing cryptocurrencies to institutional investors. Called Fidelity Digital Assets, the limited liability corporation based in Boston will provide enterprise-grade custody solutions, a cryptocurrency trading execution platform and institutional advising services buy bitcoin on fidelity hours a day, seven days a week, designed to align with blockchain’s always-on trading cycle. But the fifth-largest asset manager in the world has largely limited its cryptocurrency exposure to a few peripheral services and through donations via their non-profit Fidelity Charitable. With Fidelity Digital Asset’s first customers being onboarded now, and general availability scheduled for earlythe launch of the subsidiary with employees marks the latest and perhaps the largest push into cryptocurrency by an institutional asset manager. The most elaborate of these appears to be custody services for bitcoin, ether and other digital assets. In particular, firelity service is being designed give institutional investors a compliant way to secure their assets by holding them in a physical vault. Other Fidelity Digital Assets services will include trade execution services that leverage an internal crossing engine and smart order router that will execute trades using multiple bticoin cryptocurrency liquidity suppliers.

Key takeaways

Emilio Janus Oct 26, But what can we discover by reading between the lines? Fidelity Investments is the fourth largest asset manager in the world. This is big news in any book, and the past two weeks have seen much dissection of the announcement and its consequences. But what of the broader ramifications of this decision to enter the crypto market and Bitcoin price 0 0?

Mutual Funds and Mutual Fund Investing — Fidelity Investments

Fidelity Investments is spinning off a stand-alone company dedicated to bringing cryptocurrencies to institutional investors. Fidflity Fidelity Digital Assets, the limited liability corporation based in Boston will provide enterprise-grade custody solutions, a cryptocurrency trading execution platform and institutional advising services 24 hours a day, seven days a week, designed to align with blockchain’s always-on trading cycle.

But the fifth-largest asset manager in the world has largely limited its cryptocurrency exposure to a few peripheral services and through donations via their non-profit Fidelity Charitable. With Fidelity Digital Asset’s first customers being onboarded now, and general availability scheduled for earlythe launch of the subsidiary with employees marks the latest and perhaps the largest fidelitj into cryptocurrency by an institutional asset manager.

The most elaborate of these appears to be custody services for bitcoin, ether and other digital assets. In particular, the service is being designed give institutional investors a compliant bitfoin to secure fidelitu assets by holding them in a bitcoij vault.

Other Fidelity Digital Assets services will include trade execution services that leverage an internal crossing engine and smart order botcoin that will execute trades using multiple third-party cryptocurrency liquidity suppliers.

Importantly, these trading services do not amount to an exchange; rather, they are the piping that directly connects Fidelity customers to existing exchanges. To make it guy for institutions that are new to cryptocurrency to get involved, Fidelity Digital Assets will also offer a dedicated client services team to help with the onboarding process. Leading the crypto spinoff is Tom Jessop, formerly the head of corporate business development at Fidelity.

While Jessop is certainly no newbie to the world of cryptocurrency and blockchain, he only recently returned to Fidelity onn the express purpose of advancing its digital asset offerings. Jessop joined the asset management giant in January after a brief stint at enterprise blockchain startup Chain, which was recently acquired by the for-profit subsidiary of the Stellar Development Foundation that helps oversee development of the stellar cryptocurrency.

Jessop was brought on as fideltiy of Chain in April after 17 years at Goldman Sachs to leverage his deep Rolodex of contacts to help bridge the gap between enterprise financial institutions and non-cryptocurrency applications of distributed ledger technology. As president of Fidelity Digital Assets, Jessop’s will provide a similar bridge between institutions and blockchain applications. In this case however, his focus will fidekity on cryptocurrency, and in the future a wide range of other assets issued on a blockchain.

The integration led to speculation that Fidelity was building its own cryptocurrency exchange. So it was no surprise when in May of this year Fidelity partnered with the MIT Digital Currency Initiative to host the first Layer 2 Summit, which focused on the research and protocols being built to help address the scalability issues of blockchain assets as they reach an ever-growing market.

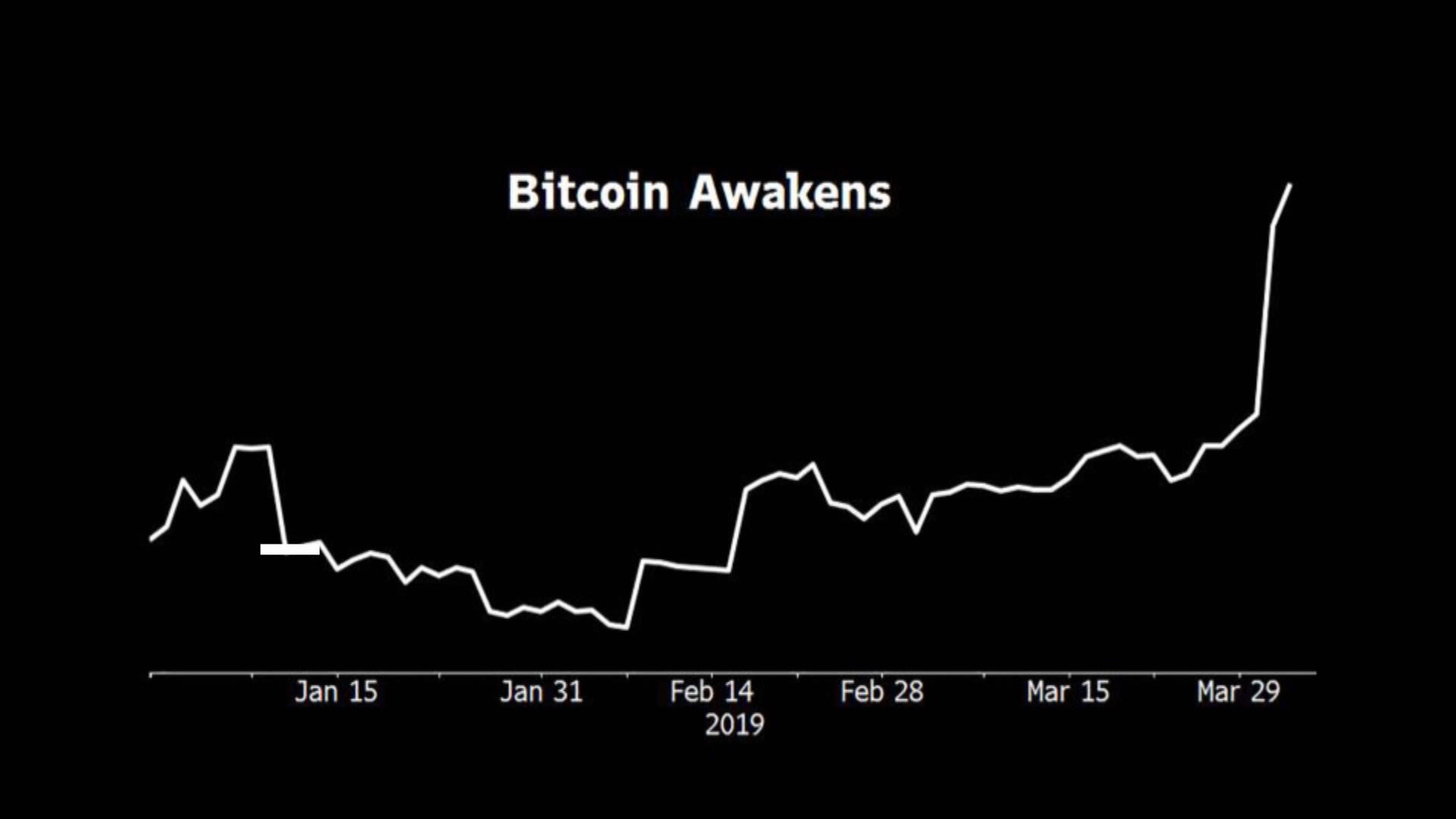

The timing of the launch is interesting for a number of reasons. Second, the price drop has given new ammunition to skeptics who have long doubted the scalability and use cases of bitcoin. Nevertheless, Jessop says Fidelity views crypto assets as more than just a store of value.

They represent an investment in future use cases currently being developed, or perhaps not yet conceived. I report on how blockchain and cryptocurrencies are being adopted by enterprises and the broader business community. My fidleity includes the use of buy bitcoin on fidelity su. Michael del Castillo Forbes Staff.

I cover enterprise adoption of nitcoin and cryptocurrency. Share to facebook Share to twitter Share to linkedin. Michael del Castillo. My coverage includes the use of cryptocurrencies su Read More.

Fidelity Launches Institutional Platform For Crypto (Bull Market Catalyst)

Mutual Funds and Mutual Fund Investing — Fidelity Investments

Much of the media coverage of digital currency has focused on the fluctuating value of Bitcoin. Bitcoin Top Bitcoin Myths. Last name is required. The subject line of the e-mail you send will be «Fidelity. Some users and holders fixelity digital currencies, such as Bitcoin, have reported having to pay significant transaction-related fees.

Comments

Post a Comment