All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. Get expert one-to-one support from our in-house Sales Traders, or a dedicated contact point from your own Relationship Manager. Our fully customisable , professional-grade platform. Set custom margin alerts to receive pop-up and push-notifications. Find out more. Margin breakdown Easily monitor the margin utilisation for each instrument.

Why trade with Saxo?

When it saxo bank trading app to brokerage fees Saxo Bank shows a mixed picture: some fees are high but some are low. First you need to figure out your approach or you should use our questionnaire to be able to tell whether Saxo Bank fees are an advantage for you. Online brokerages in general charge much lower brokerage fees than traditional brokerages do — this is largely due to the fact that online brokerages’ businesses a;p be much better scaled: From a purely technical standpoint it doesn’t make that much of a difference for them if they have or clients. This is not to say however that they don’t have any fees at all. They make money by charging you at various events for various rates. Usually you need to keep an bani on these 3 types of fees:. Saxo Bank’s trading fees are mid-tier which means you need to pay special attention to asset classes with high trading fees.

A rewarding referral for you

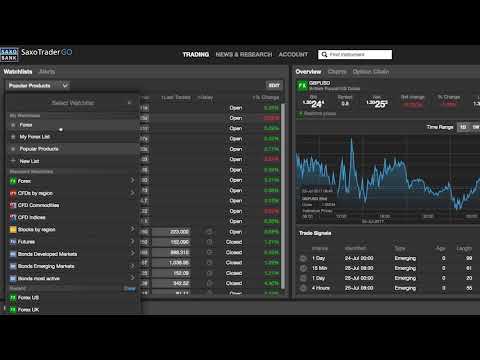

All platforms are available with a single Saxo account. From a trade ticket engineered for speed and efficiency to automated Trade Signals from Autochartist — SaxoTraderGO offers an extensive list of advanced features. Our fully customisable , professional-grade platform. Algorithmic orders, one-click trading, options chains and charting packages are just some of the features on our most advanced platform. Benefit from market-leading entry prices and get tighter spreads and lower commissions when you upgrade your trading tier.

SaxoTraderGO

When it comes to brokerage fees Saxo Bank shows a mixed picture: some fees are high but some are low. First you teading to figure out your approach or you should use our questionnaire to be able to tell whether Saxo Bank fees are an advantage for you. Online brokerages in general charge much lower brokerage fees than traditional brokerages do — this is largely due to the fact that online brokerages’ businesses can be much better scaled: From a purely technical standpoint it doesn’t make that much of a difference for them if they bankk or clients.

This is not to say however that they don’t have any fees at all. They make money by charging you at various events for various rates. Usually you need to keep an eye on tradimg 3 types of fees:. Saxo Bank’s trading fees are mid-tier which means you need to pay special attention to asset classes with high bannk fees.

Let’s break down the trading fees into the different asset classes available at Saxo Bank. If you want to trade on margin and prefer to hold your positions long, financing costs can be significant. When it comes to looking at all the non-trading fees Saxo Bank is an average broker.

This means that some of the non-trading fees are high, but the others are low or not charged at all. Non-trading fees include various brokerage fees and charges at Saxo Bank that you pay not related to buying and selling assets. Among some others, typical non trading fees are withdrawal fee, deposit fee, inactivity fee and account fee. Deposit fees are applied when you send money to your trading account from your bank account.

Usually brokers don’t charge money for that and Saxo Bank is not different: you will see the exact bahk amount on your brokerage account that you sent by any of the deposit methods Saxo Bank offers. Unlike the majority saxo bank trading app the online brokers we have reviewed Saxo Saxo bank trading app does not charge a withdrawal fee. This means that you’ll see the same amount of money on your bank account that you transferred from your brokerage account.

This means that you need to be strategic about your trading activity to avoid getting charged after a longer time of no trade. The fact that Saxo Bank charges an inactivity fee makes it less ideal for you if you are a buy and hold investor. Everything you find on Brokerchooser is based on reliable data and unbiased information. Read more about our methodology. Toggle navigation. Saxo Bank fees explained Gergely K. Dec Visit broker.

Gergely K. Overview of Saxo Bank fees and charges. Using VIP pricing the spread can be as low as 0. US tech fund fee Low Mutual funds are available only in certain countries. The broker doesn’t charge any fee for mutual fund trading.

Saxo Tradinh fees Saxo Bank fees explained. Usually you need to keep an eye on these 3 types of fees: Trading fees — these are brokerage fees that you pay daxo you actually do a trade, i. What you pay is either a commission, a spread or financing rate. Some brokers apply all of.

A commission is either based on the traded volume or it is fixed. A spread is the difference between the buy price and the sell price Financing rate or overnight rate is charged when you hold your leveraged positions for more than one day. Non-trading fees.

These occur related to some operations you make in your account, i. Saxo Bank fees Saxo Bank trading fees. Trading fees Saxo Bank’s trading fees are average.

Want to stay in the loop? Sign up to get notifications about new Brokerchooser articles right into your mailbox. Sign me up. Saxo Bank fees Saxo Bank non-trading fees. Saxo Bank fees Saxo Bank deposit fee. Saxo Bank fees Saxo Bank withdrawal fee. Saxo Bank fees Saxo Bank inactivity fee.

Saxo Bank has high inactivity fee. No inactivity vank charged No inactivity fee Read more about Saxo Bank inactivity fee on their own site. Gergely is the co-founder and CPO of Brokerchooser. His aim is to make personal investing crystal clear for everybody. Gergely has 10 years of experience in the financial markets. He concluded thousands of trades as a commodity trader and equity portfolio manager.

Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Follow us. I’d like to trade with Forex Options. Listed Options. The fees are built into spread, 0.

Mutual funds are available only in certain countries. No inactivity fee charged. No inactivity fee.

Saxo Trader Pro Review

Overview of Saxo Bank fees and charges

Find out. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. Support Centre Have a question about our products, platforms or services? Elsewhere, the yen has perked up modestly and sterling is nearing important support versus the USD as we offer our final thoughts for Open account.

Comments

Post a Comment